Most people whose business failed

when asked would have only said no customer patronage. But the truth is that

one fundamental causes of business failure is poor financial management. Anyone

who wants to succeed in any business be it in USA, South Africa, India, United Kingdom

or anywhere at all need to understand simple basic financial records. It is

undoubtedly true that most businesses, especially small businesses do not keep

financial records even simple ones. In this article, we are going to look at

how to keep financial record for your business and the easiest and simple way

to do it for small to medium business be it offline or online.

Most people whose business failed

when asked would have only said no customer patronage. But the truth is that

one fundamental causes of business failure is poor financial management. Anyone

who wants to succeed in any business be it in USA, South Africa, India, United Kingdom

or anywhere at all need to understand simple basic financial records. It is

undoubtedly true that most businesses, especially small businesses do not keep

financial records even simple ones. In this article, we are going to look at

how to keep financial record for your business and the easiest and simple way

to do it for small to medium business be it offline or online.

You might be producing the best product,

rendering the best service, marketing your goods. If you don’t have a proper

financial management, you will not be able to keep track of your spending and

income in the running of your own business. This will no doubt affect your

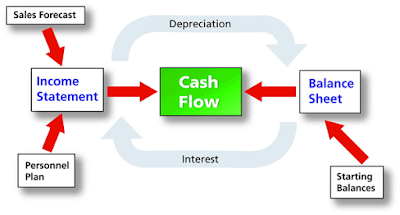

company financial health. Cash flow understanding and management is the key to

the health of any business and you need it in your own business. Never start a

business of any kind without having a good financial management even at basic

levels.

The basic things you need to have a

sound financial management system in place no matter the size of your company.

It will surprise you to know that big companies have also collapsed due to lack

of proper financial management and planning.

Note that you do not need to use all

the complex record keeping systems that accountant uses, but you should be able

to have a system in place that supports your cash flow, receipt and payments,

bank deposits, impress and purchases as well as other financial details. You

could start by buying record books to record all your business financial

transactions as they are carried out. The mistake most people make is to assume

that they will remember all their financial transactions in their head. As I

consult, I meet clients who just never have a record book until I show them the

need as they are not able to track all their business transactions. Sometimes,

they even lose money which they are not able to account for.

You need to open a bank account for

your business and this account MUST, I repeat, MUST be separate from your

personal bank account. You should not use your business bank account to solve

personal problems or use your personal account for business expenses. However,

if you must have the two accounts together as one, then you will also need to

have proper detailed and clear record identifying personal and business records

for easy tracking in your cash book. You need to show, mark or treat your

personal expenses from the account as non-business expenses.

My advice again is that you try as

much as possible to be disciplined so you will not deep your hand into your

business income for personal use as this will affect your income in the end.

Let us see all you need to have control over.

The Importance of Using Cash Book For Financial Record Keeping

A cashbook is a simple record

keeping book that will show your purchases, expenses, sales and receipts. There

is no single way to do this. You can make it in any way that is easy and simple

for you to understand. All you need to do is make basic details of transactions

including receipts, cheques, cash, credit cards or even any other methods that

you deem fit to include. You could have two books or one to keep all your

records and this is entirely what you decide.

If you are recording in just one

cashbook, then you can separate them into payment and receipt sections and make

them in detail.

If you are recording in just one

cashbook, then you can separate them into payment and receipt sections and make

them in detail.

It’s up to you to decide whether you

want to record payments and receipts in one book or two separate books. If you

choose to record in one book, your cash book will generally be in the following

two parts;

Payments Record

You need

to record all the money going out of your business. It is important that you do

this with discipline to the later and show your account personnel how to do

this, even if you operate a small business. You also need to live by example. It

is also important that you pay promptly for goods you purchase for your

business on time and record them here in detail.

Let us use an example here, a

Business Center may be buying photocopying paper, fuel, printer ink, An

internet Café may be buying Internet Subscription, Electricity bill, etc all

these spending must be recorded here.

Understanding Using Receipt Section For Book Keeping:

This part of your cashbook is for

money coming into the business. These are money paid to you for your goods or

services. For example, all the money you made from your customers paying you

for supply of bread loafs if you are bread. This is what you will record here.

If you have several products or

services for example a business center, you may have to divide this section

into photocopying, sale of recharge cards, internet browsing, photography and

passport . This will also make proper and sound business decision and analysis

on which product is moving better than the other. Also it will help you know

when your stock is going down.

If your company is involved in high

volume business transaction, you may have to use cash register and transfer the

total amount to your receipt section once in the sum total at the end of every

daily transaction.

What you need to understand and know about Petty Cash Book

Keeping of petty cash is also very

important. This helps you keep minor expenses separate from your cash book. Keeping

petty cash is important and you need to know and figure out how much you can

always keep as petty cash and any amount you take from your normal account to

serve as petty cash by cheque or cash must be recorded in your cash book.

For example, you may decide to

reserve N5,000, N100,000, GHc500, Sh1000, $1000, $300 etc and this is largely

dependent on your type and nature of business. My advice is that you should

discipline yourself not to have too much cash on hand.

I also advise that you have this

money kept in a secure place and have it recorded in your cashbook but do not

record as expense yet as you have not spent it on anything yet. Once you spend

from there, you will now record it as expenses.

It is also important to do monthly

or weekly bank reconciliation to update and know and see that cashbook agrees

with your bank statement.

Knowledge is power but applied

knowledge is more powerful. It is therefore good to start implementing your

financial planning now and as you progress, you will discover that you will

understand your business much more and you will be able to make more important

business decisions.

It is important that when starting

your financial planning and records, you will need to make it very simple.

Always balance your account and make sure your payment and receipt section

balances. Never overlook anything and let your staff also be on the know of

what is happening so they are carried along. I mean your account section. And

in the end, you will know if your business is making profit or a loss.

No comments:

Post a Comment